US credit downgrading triggers sell-off on D St

Sensex, Nifty plunge 1% on weak global trends, foreign fund outflows

image for illustrative purpose

Mumbai Equity benchmark indices Sensex and Nifty fell by 1 per cent on Wednesday on weak global market trends and continuous foreign fund outflows.

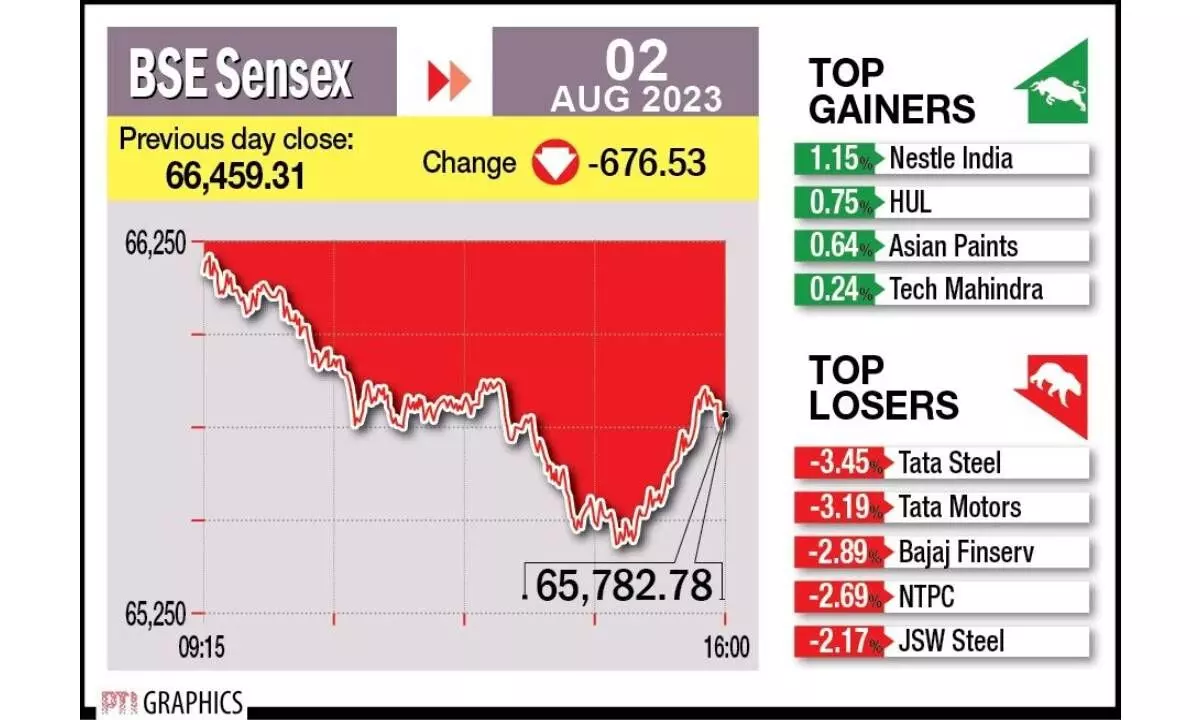

Fitch Ratings has downgraded the United States government’s credit rating, citing rising debt at the federal, state, and local levels and a “steady deterioration in standards of governance” over the past two decades. The rating was cut on Tuesday one notch to AA+ from AAA, the highest possible rating. The 30-share BSE Sensex tumbled 676.53 points or 1.02 per cent to settle at 65,782.78. During the day, it cracked 1,027.63 points or 1.54 per cent to 65,431.68. The NSE Nifty fell by 207 points or 1.05 per cent to end at 19,526.55.

“The Indian market witnessed a broad sectoral slide, affected by weak global market trends. Negative news regarding the US rating downgrade on fiscal concerns, coupled with weak factory activity data from Eurozone and China, led to widespread worries across the globe. “Additionally, prolonged FII selling, triggered by a rise in US bond yields, has disrupted the mood of the domestic market,” said Vinod Nair, Head of Research at Geojit Financial Services.